Thank You

In case it does not download automaticaly please click the below link to download the report.

Click HereOops! Something went wrong while submitting the form.

Africa Edition

Eyeing Economic Boom Amidst Crime and Logistics Challenges

The last mile in Africa is at a defining moment – choices made now will shape the continent’s delivery ecosystem for years to come. With the advent of international giants in retail, rapidly changing global dynamic and rising concerns around safety, South Africa is at a tipping point.

Eye on the Last Mile – South Africa is our first in-depth report capturing this pivotal stage. Drawing insights from 500+ senior professionals across transportation, operations, technology, procurement, and compliance, it highlights the challenges, priorities, and strategies shaping logistics across Africa.

Here are some glimpses into the findings set to redefine African logistics and supply chains.

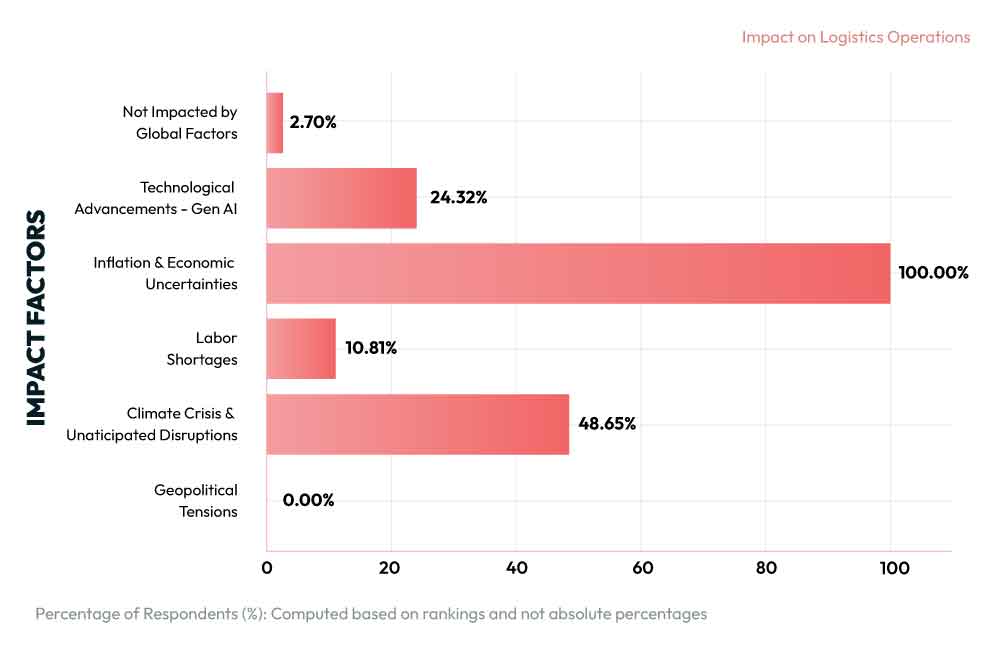

Inflation is the dominant concern for all respondents, making cost management the top driver of last-mile decisions. Nearly half also emphasized climate change, highlighting sustainability as a critical factor, while about a quarter pointed to emerging technologies like GenAI as key differentiators. Unlike many global markets, South Africa faces fewer challenges from labor shortages and geopolitical tensions, giving it a relative advantage.

Customer experience is a top priority, reflecting the need to deliver outstanding service and build loyalty. Real-time tracking has become essential as customers demand transparency and timely updates. Route and fleet optimization are equally critical, enabling faster deliveries at controlled costs. With global players entering and demand rising, our study explores the key focus areas shaping last-mile strategies for business leaders in this evolving landscape.

Cost stands out as the most critical challenge in last-mile delivery technology, with a striking importance score of 154.05%, clearly dominating decision-making. Scalability and adaptability follow distantly at 16.22% each, highlighting their relevance but lower urgency. Tracking (10.81%) and visibility (8.11%) are noted concerns, though far less pressing. Overall, cost considerations outweigh all other factors.

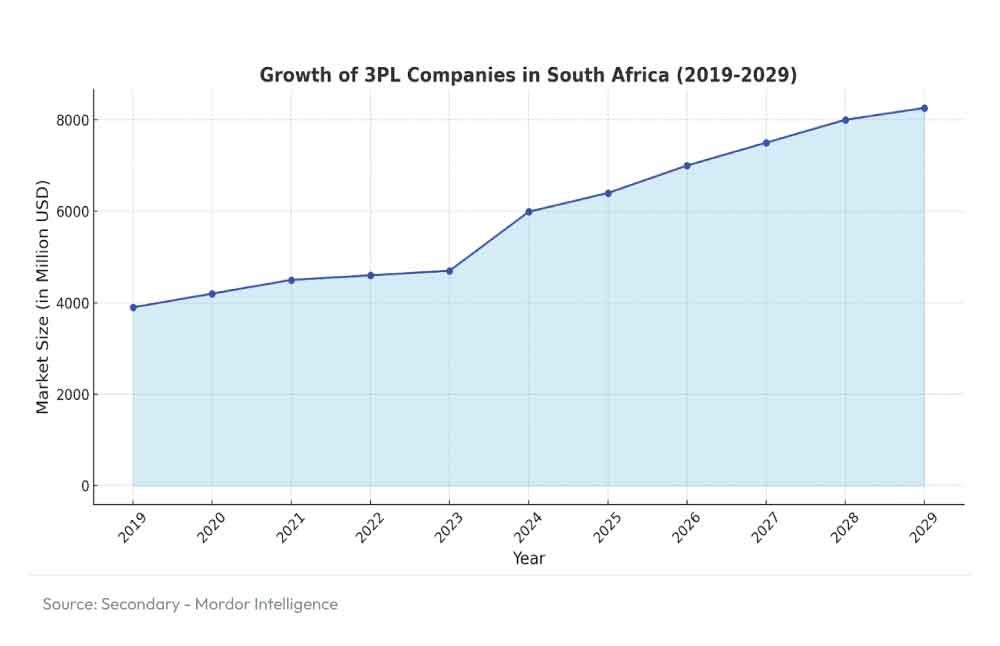

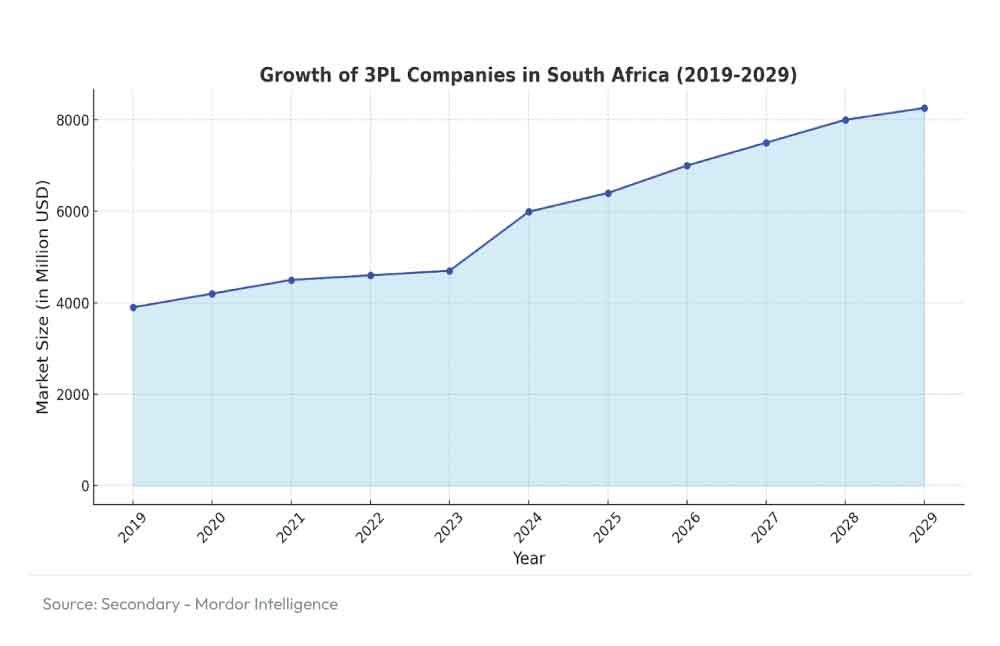

A higher share of outsourced fleets shows that companies are relying heavily on third-party logistics (3PL) to cut costs and stay flexible. The limited use of owned fleets suggests a preference for outsourcing over managing in-house operations, likely to avoid cost and complexity. Looking ahead, firms will refine their outsourcing strategies for efficiency while hybrid fleet models are expected to grow, offering both flexibility and stronger customer service.

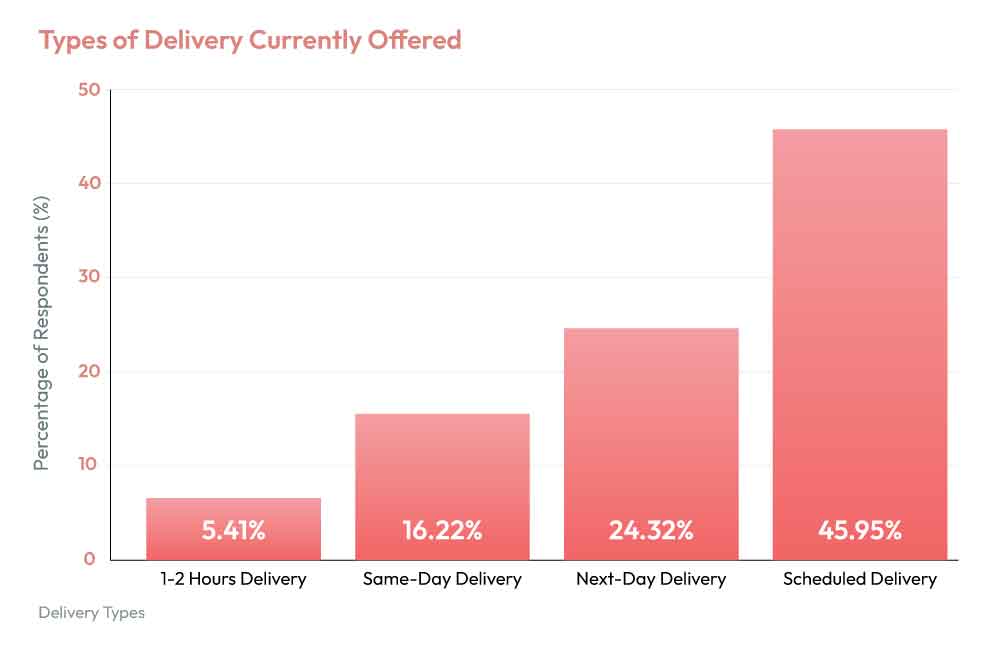

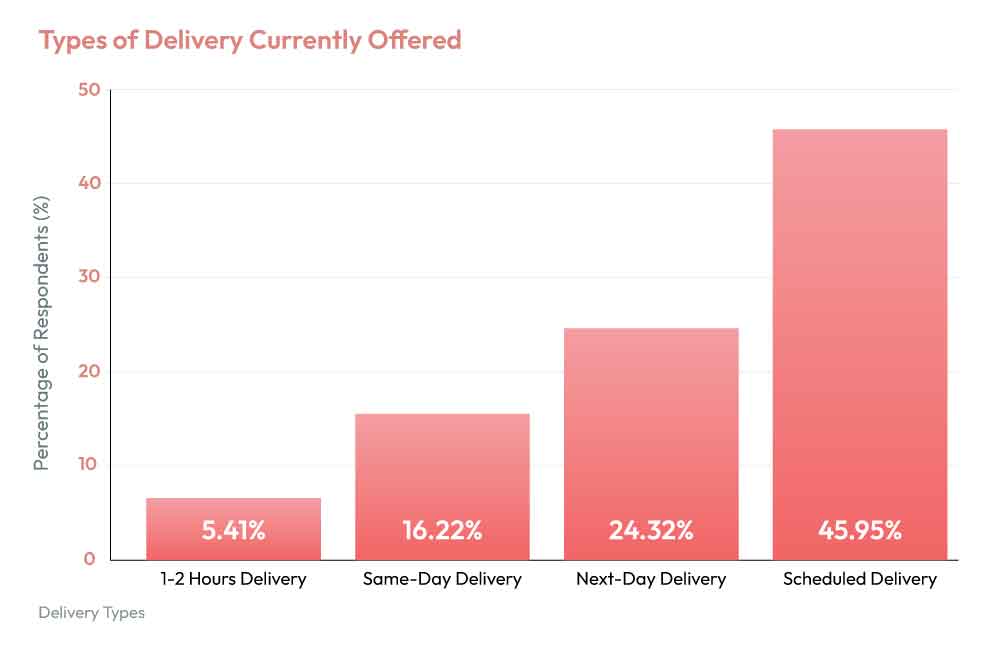

Our study reveals a critical shift in how companies deliver, with global competition driving massive change ahead. To remain competitive, businesses must assess delivery readiness and upgrade processes, systems, and infrastructure to meet rising customer expectations. Currently, 45.95% of deliveries are scheduled, 24.32% are next-day, 16.22% are same-day, and 5.45% are same-hour signaling the urgent need for speed, flexibility, and operational resilience in last-mile logistics.

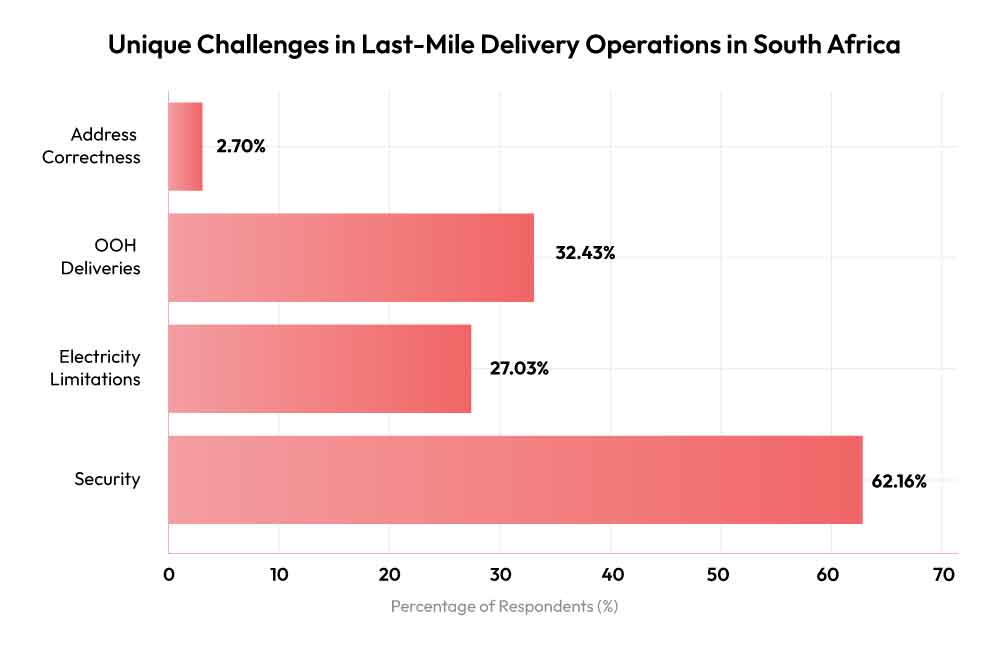

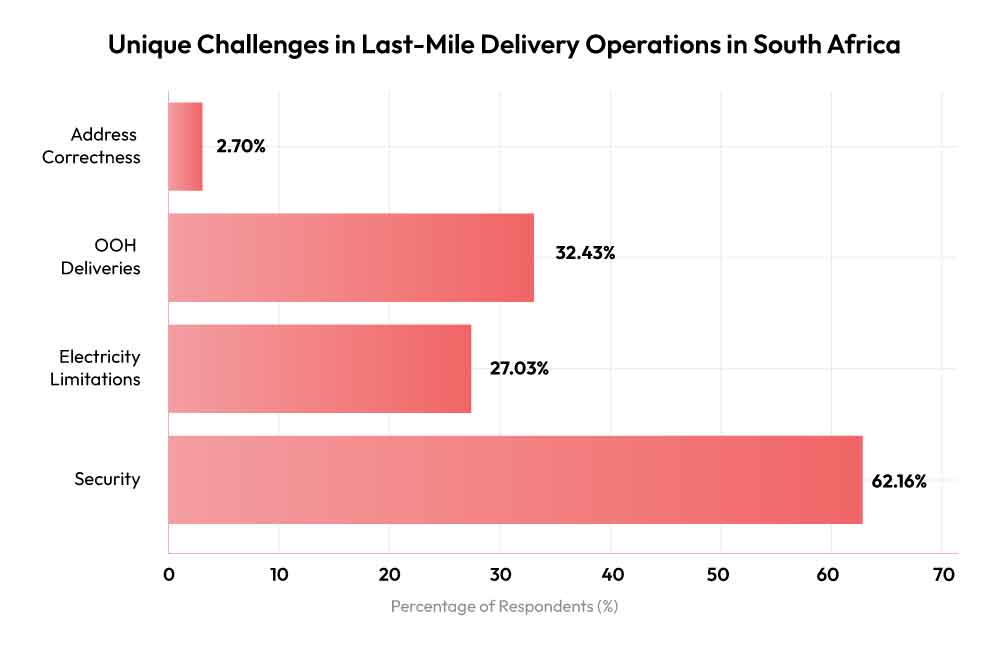

Findings show that security is the top challenge in South African last-mile delivery, alongside issues like OOH deliveries, electricity shortages, and address accuracy. Overcoming these requires a mix of technology, infrastructure upgrades, and stronger security measures. As e-commerce expands, companies that act early to address these pain points will gain a competitive edge, delivering better service quality and greater operational efficiency in the last mile.

Africa Edition